Amazon announces 20-1 Stock Split and $10 Billion Share Buyback

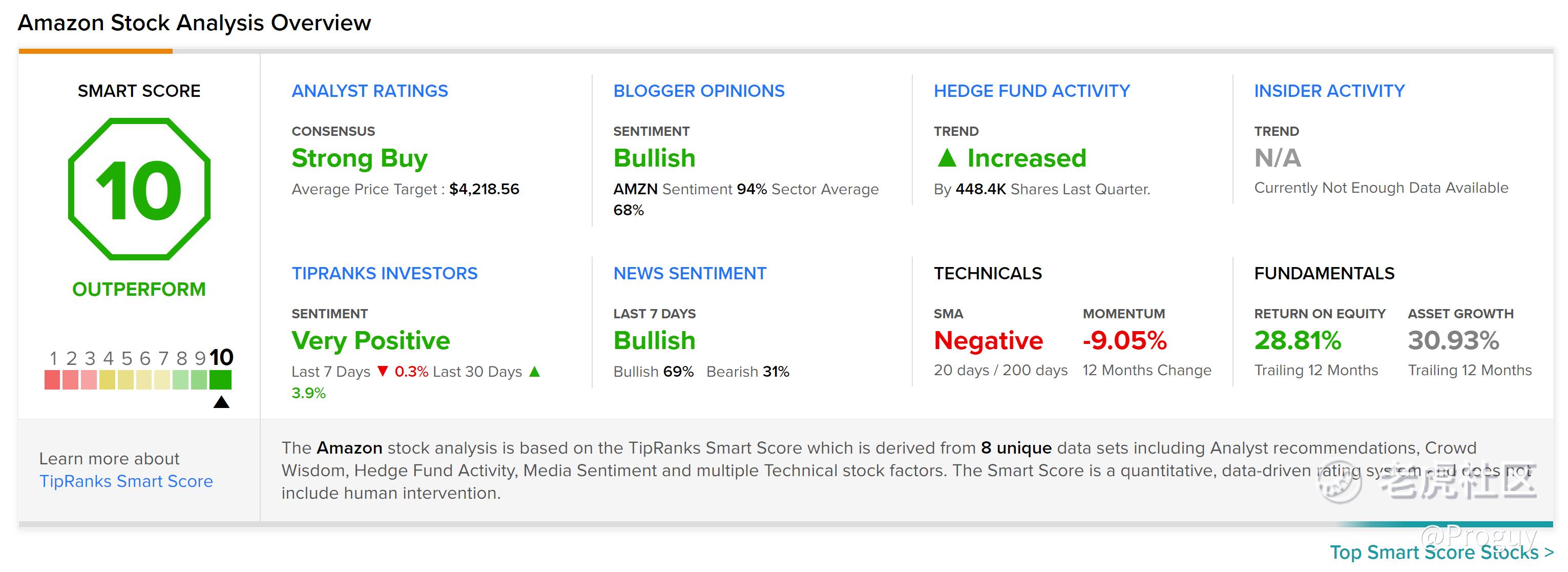

On Wednesday, Amazon ($Amazon.com(AMZN)$) announced a 20-1 stock split and a $10 billion share buyback programme which has been approved by its Board of Directors. Wall Street Analysts have been bullish on this move, with Deutsche Bank upgrading its price target to $4100, indicating a 40% upside in AMZN's stock.

Stock splits are generally seen as a positive by the market. Companies are often put in a position to split their stocks only after an extended period of strong returns. Once the price of a stock or fund gets too high, even single shares may become too expensive for small, retail investors, limiting demand for the stock. In addition to ensuring access to all investors, a stock split is typically also an indication that management doesn’t see the current market value as overinflated, another bullish sign. Source: Benzinga

Following the announcement, AMZN's shares jumped 5.41% as investors see this move as a positive catalyst moving forward. According to Ivan Feinseth, chief investment officer for Tigress Financial Partners, "Amazon's buyback announcement marks a change in direction from its typical approach of reinvesting in its business." However, a flip side to this statement could be that AMZN has run out of ways to grow its business and is finding ways to generate value for shareholders instead of reinvesting its profits.

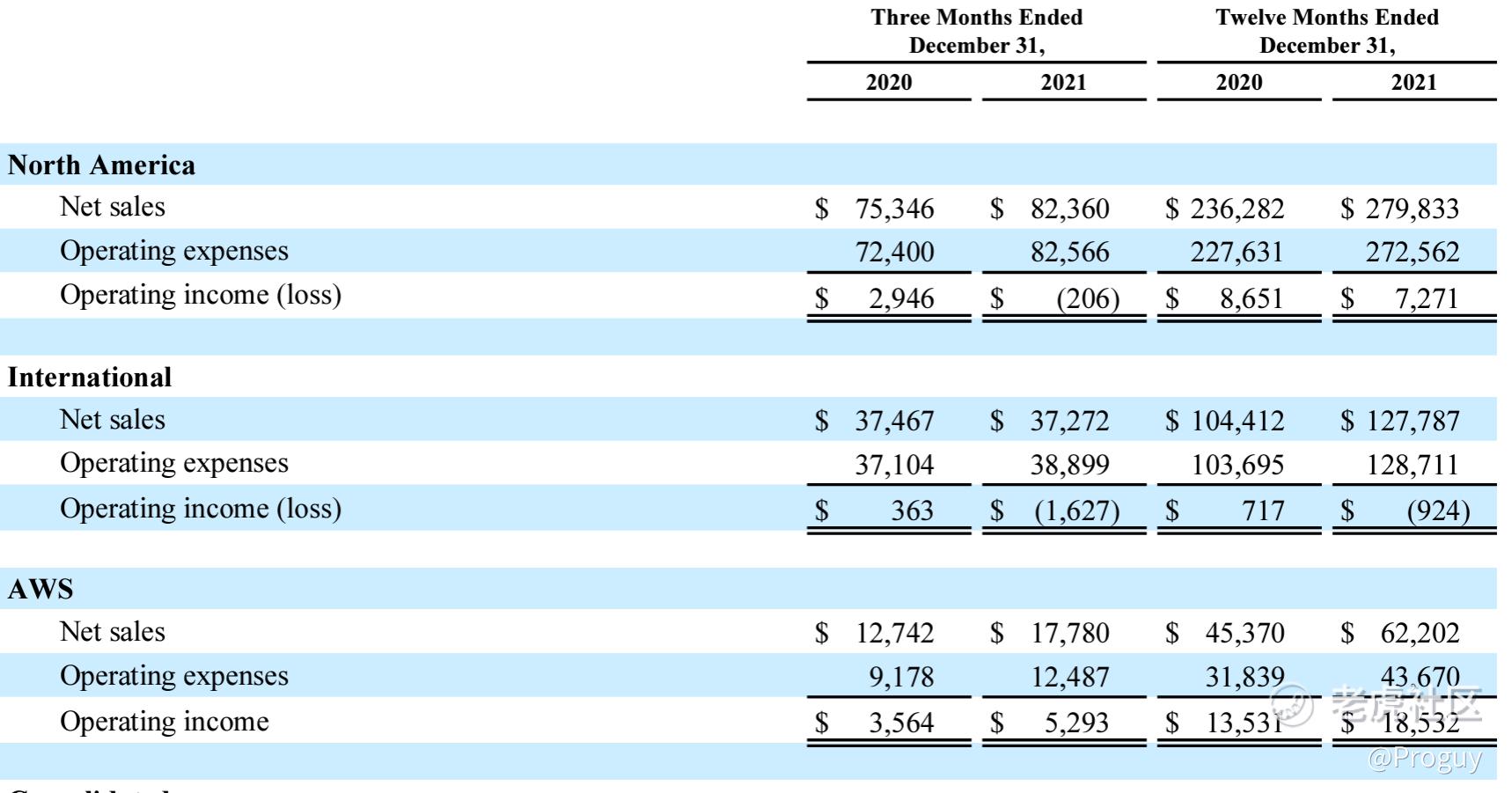

According to AMZN's latest quarterly report, Amazon's Operating Income from North America and International e-commerce shrunk to $7,271 and $(924) respectively. The only savings grace was its AWS business which grew sales by 40% annually and its operating income by 37%. As the company continues to experience inflationary pressures due to factors such as higher wages, its e-commerce business faces increasing bottom-line pressure. Revenue growth also slowed to 9% YoY, down from 40% in 2020. This indicates that following the global economic reopening, people are spending more time and money on physical stores versus e-commerce.

Despite these headwinds, investors appear to be extremely bullish on AMZN's stock. Both the buy-side and sell-side have positive ratings on the stock as institutional investors continue to pile into the stock. The upcoming stock split could present an opportunity for retail investors to accumulate shares of AMZN at the adjusted price. However, it is important to consider whether AMZN's fundamental story is still intact. These are questions investors should ask themselves before deciding to buy AMZN's stock:

- Does the company still have the opportunity to grow or was its sales driven by the pandemic?

- Are its competitors eating at its market share?

- What are the prospects of its AWS cloud segment?

Let me know your thoughts on the company and this move as well as whether you will be buying AMZN shares post-split.

精彩评论