10/3/22 Market Report: Feb 2022 Inflation Data

The US Bureau of Labor Statistics is expected to release the Feb 2022 Consumer Price Index results at 08:30 AM today.

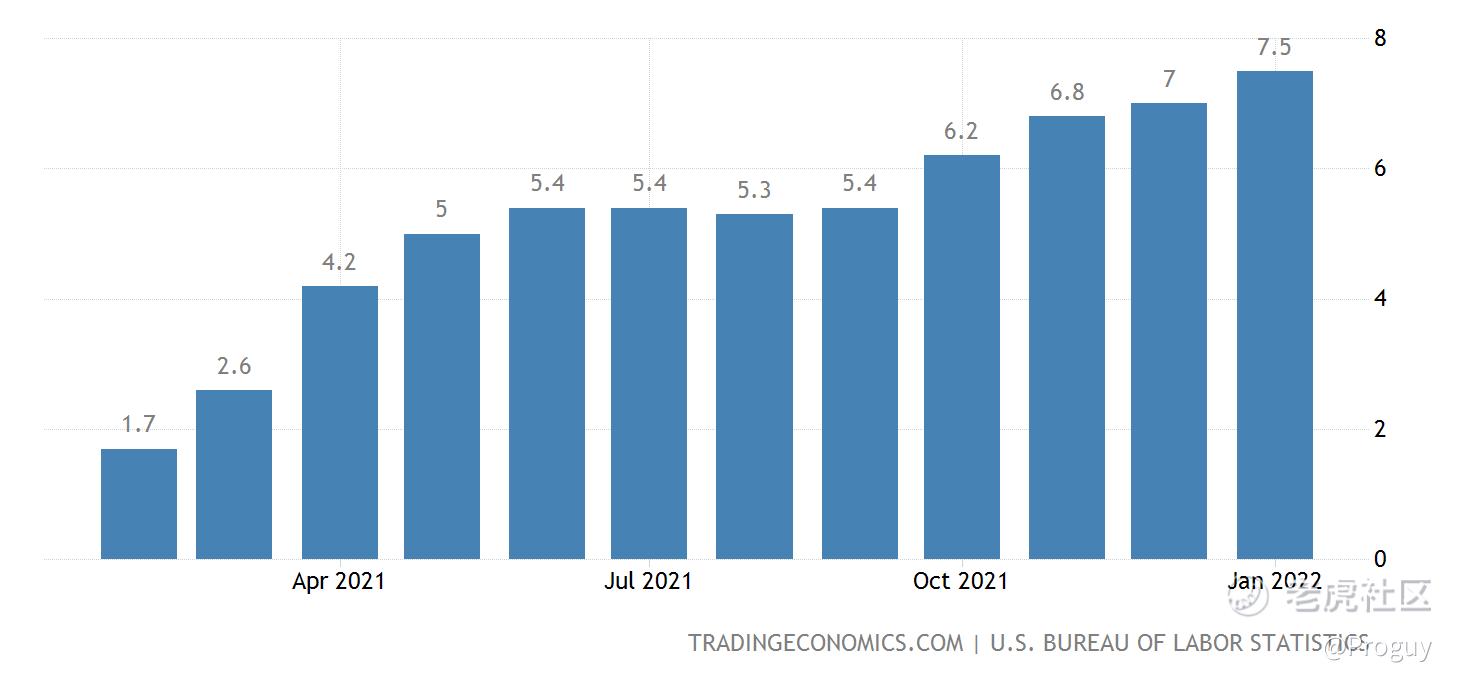

Annual inflation rate in the US likely accelerated to 7.9% in February of 2022, the highest since January of 1982 and core inflation is expected to rise to 6.4%, also the highest in 40 years. The monthly rate is seen at 0.8%, above 0.6% in January. The CPI data will likely show prices climbed across a broad array of goods and services, including hospitality services and restaurants while gasoline prices increased almost 41% from last year. Still, the biggest effects of the war in Ukraine and the consequent surge in energy costs are still to come and will worsen with the US ban on oil imports from Russia. The inflation was seen peaking in March but the recent developments in Europe coupled with the ongoing supply constraints, strong demand and labour shortages will likely maintain inflation elevated for longer. Source: US Bureau of Labor Statistics

Implications on the Market

Nasdaq futures fell almost 1% in pre-market trading as investors access the ongoing effects of the Russia-Ukraine war on inflation and the Fed's decision to hike interest rates during the upcoming FOMC meeting on March 15-16.

The$E-mini Nasdaq 100 - main 2203(NQmain)$ 4h chart is currently trading between a range of 13,120 and 14,000. Bearish news could send the index below 13,120 while bullish news could see the index break above 14,000. Momentum indicators are indicating that a bearish reversal after yesterday's 3.60% rally is likely as they are falling overbought levels. Regardless of price action and given the current market volatility, traders should practice proper risk management and implement tight stop-losses when executing their trades.

精彩评论