16/3/2022 Market Report: Markets rebound, Hang Seng Index experiences best day since 2008

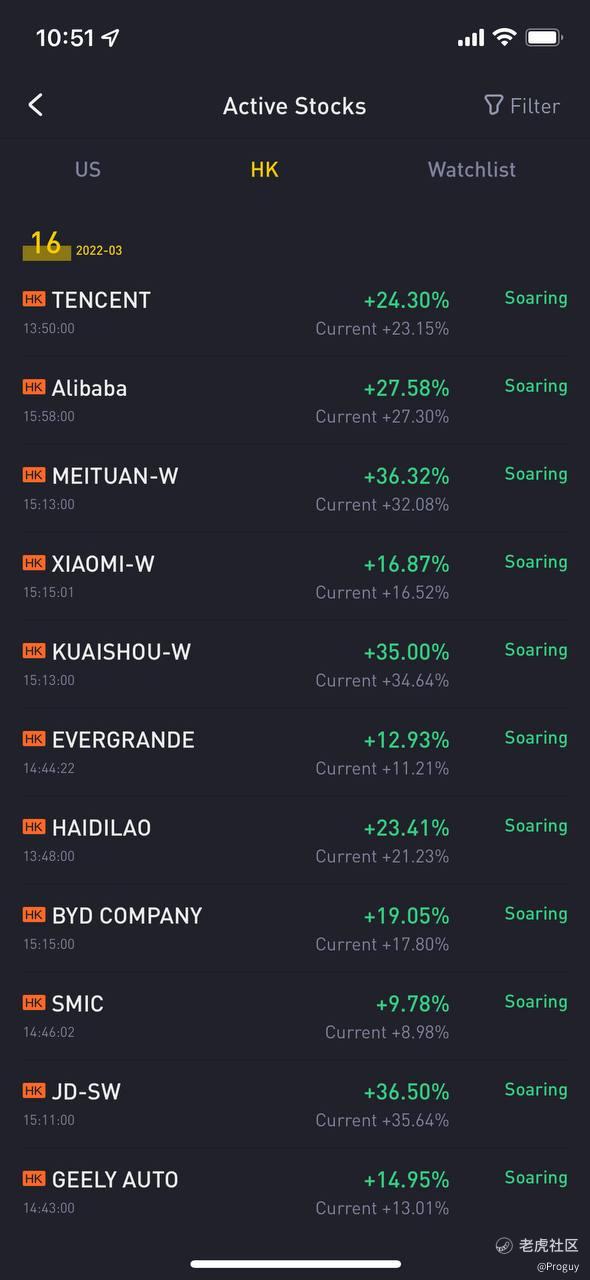

On Wednesday, the Hang Seng Index ($HSI(HSI)$) surged 9%, rebounding from its lowest close in six years after China expressed its support for overseas listings and signaled that the recent regulatory crackdown on Big Tech companies could be near its end. According to a report by Chinese state media, Chinese and U.S. regulators are progressing toward a cooperation plan on U.S.-listed Chinese stocks. Chinese authorities also said that they were working towards the stability of Hong Kong's financial markets and its struggling real estate sector.

Following the news, tech giants Alibaba, Tencent and Meituan surged more than 20%, while other major Chinese tech stocks rallied strongly.

"The Chinese government continues to support various kinds of businesses' overseas listings," the state media report said in Chinese, translated by CNBC. The article said regulators should "complete as soon as possible" the crackdown on internet platform companies.

Have we hit the bottom?

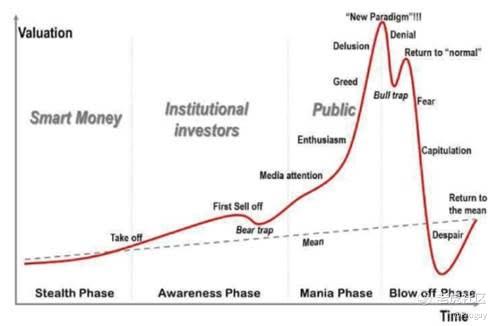

While it is unclear whether Chinese internet stocks have bottomed after the recent selloff, there are positive signs which indicate that the market could rebound in the short term. As more people turn bearish on the Chinese internet sector, this could lead to fewer sellers and a rebound in stock prices. Recently, JP Morgan downgraded 28 Chinese internet stocks calling them unattractive and that the "sector-wide sell-off might continue given the lack of valuation support in the near term." This pessimistic sentiment towards Chinese equities could be an indication of capitulation and a sign of a bottom. In the next few weeks, we could see smart money entering Chinese internet stocks once again, setting us up for a fresh cycle in the market.

That being said, timing the market can be difficult and finding an absolute bottom would be incredibly challenging. Research has shown that the market's best days tend to follow its worst days so panic selling can significantly lower returns for longer-term investors by causing them to miss the best days. The recent selloff and rebound in the HSI is evidence that investors should always stay invested as timing the market could lead to lost opportunities in the market.

Trading the rebound

For traders with a shorter time frame, this rebound could be a good buying opportunity. In my previous article, I commented that bullish price action supported by positive news and a shift in momentum could lead to a rally in the HSI in the short term. The daily $HSCEI ETF(02828)$ chart shows that we are bouncing from oversold levels at a level of support with bullish momentum and high volume. These bullish technical indicators highlight that there is a high probability that we will rally towards the 20MA over the next couple of days for a swing trade.

For investors trading during this period of high volatility, proper risk management including the use of stop-losses and position sizing should be exercised as a form of caution. Conduct your own due diligence before entering into a trade/investment.

精彩评论