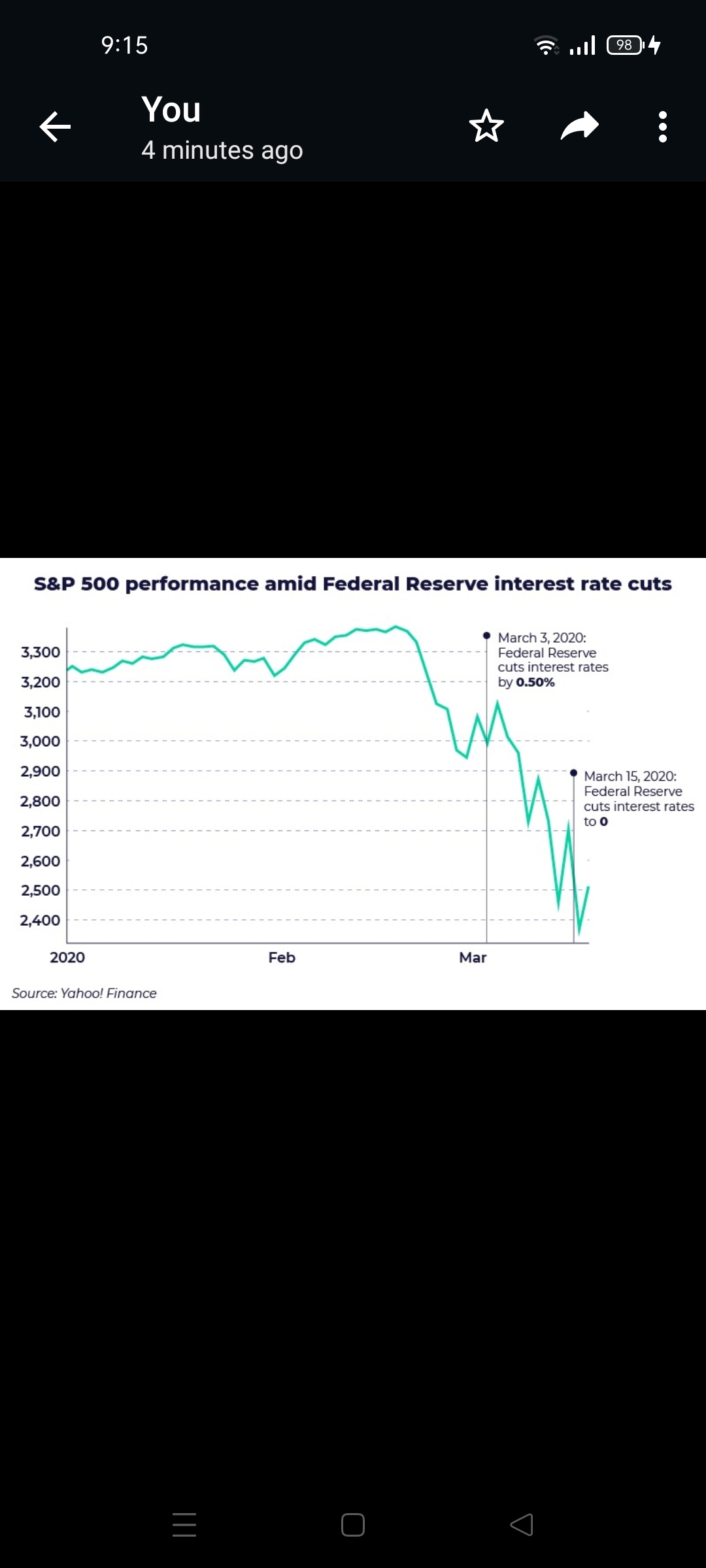

How and why interest rate changes affect stocks

Higher interest rates mean businesses are less likely to borrow money for growth and expansion, opting instead to fund reduced growth initiatives or forgo growth altogether. Because planned growth is an important component of determining a stock’s value, higher interest rates can cause investors to believe a stock is worth less. Magnifying that effect across markets can lead to widespread losses.

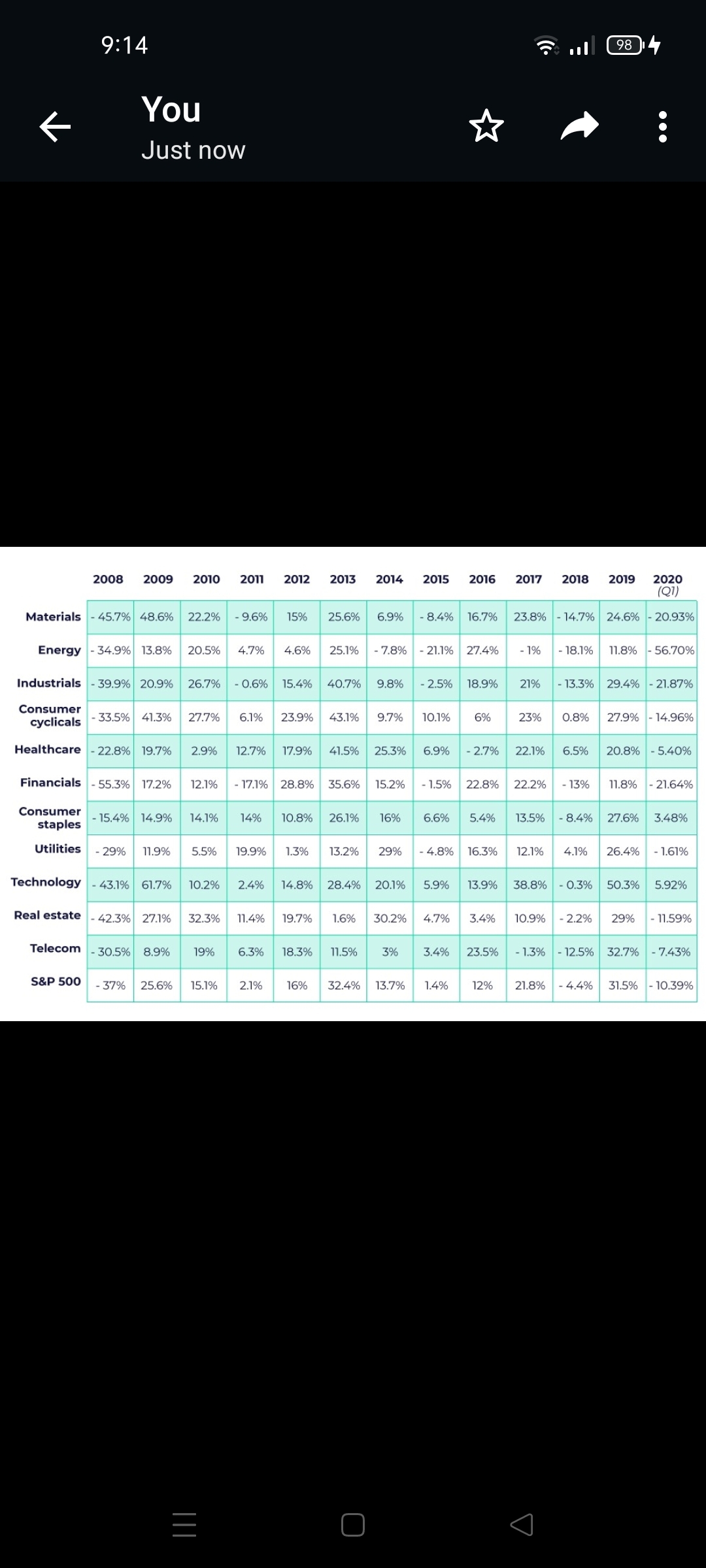

Interest rate changes: Response by market sector

1) Financials (banks, real estate investment trusts, etc.) and Consumer Staples (food, beverages, household items, etc.) are expected to underperform. That’s because financial companies earn revenue from high interest rates (think banks) and consumer staples are considered non-discretionary, meaning people need and use them roughly the same regardless of other economic factors. It’s not like you only buy dinner when you feel richer.

2) Industrials (companies that produce materials related to construction) and Cyclicals (companies that produce discretionary goods and services) tend to outperform. This happens because spending in these sectors is less essential to everyday life. When times are good and money is cheap, people build more and have more discretionary income to spend.

Read More: https://www.m1finance.com/blog/how-interest-rates-can-affect-your-investments/

精彩评论