No one can predict the bottom for sure. This is an axiom. However, there are indirect signs that allow us to assess the likelihood that the stock is at least approaching the critical moment when a reversal becomes possible. Interestingly, in the case of PayPal $PayPal(PYPL)$ , there are several such signs.

Super-exponential fall

In nature, and in the stock market in particular, linear processes are extremely rare. For example, the number of bacteria grows exponentially if there are no restrictions in nutrient resources and living space. In the field of the stock market, the most striking example of exponential growth is the long-term trend of Amazon $Amazon.com(AMZN)$ stock the price:

Now let's look at the behavior of the price of PayPal shares. Approximately from the end of July 2021 until February 2022, the company's share price was declining in accordance with an exponential trend - it was a normal correction. But from February to today, the price has been declining at a super-exponential rate:

Abnormal volume and short ratio

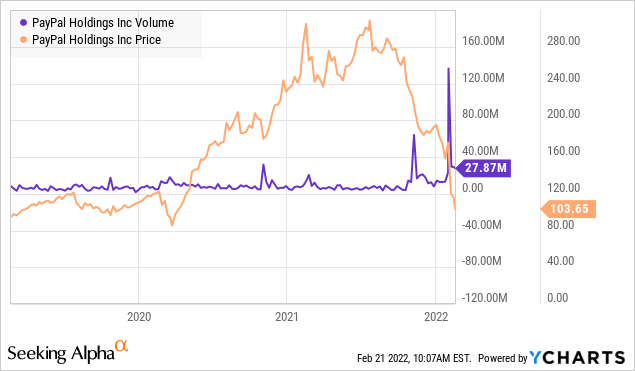

The volume of transactions in PayPal shares has recently reached unprecedented levels for the company. On Feb. 2, daily volume hit a record 136 million and continues to be above long-term averages:

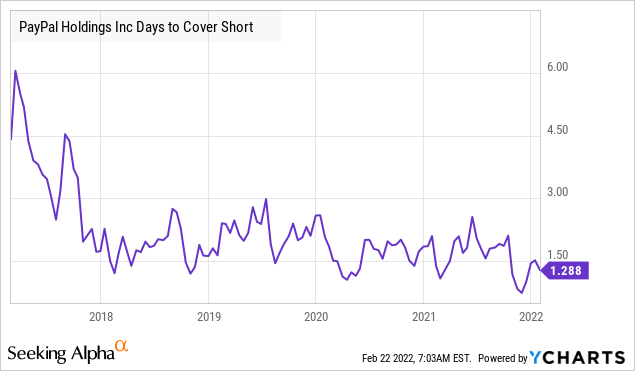

Now about the short interest ratio.

A bit of theory. Short interest is the total number of shares that have been sold by investors, but have not yet been covered or closed. But this information alone is not as valuable as when combined with trading volume. Therefore the derived indicator "Days to cover" is more indicative. It measures the expected number of days to close out a company's outstanding shares that have been sold short:

Days to cover = short interest / average daily volume

In the case of PayPal, "days to cover" is now below the average for the past five years. In my opinion, this means that the bearish momentum regarding PayPal is fizzling out:

PayPal's reaction to market dynamics

PayPal's reaction to market dynamics

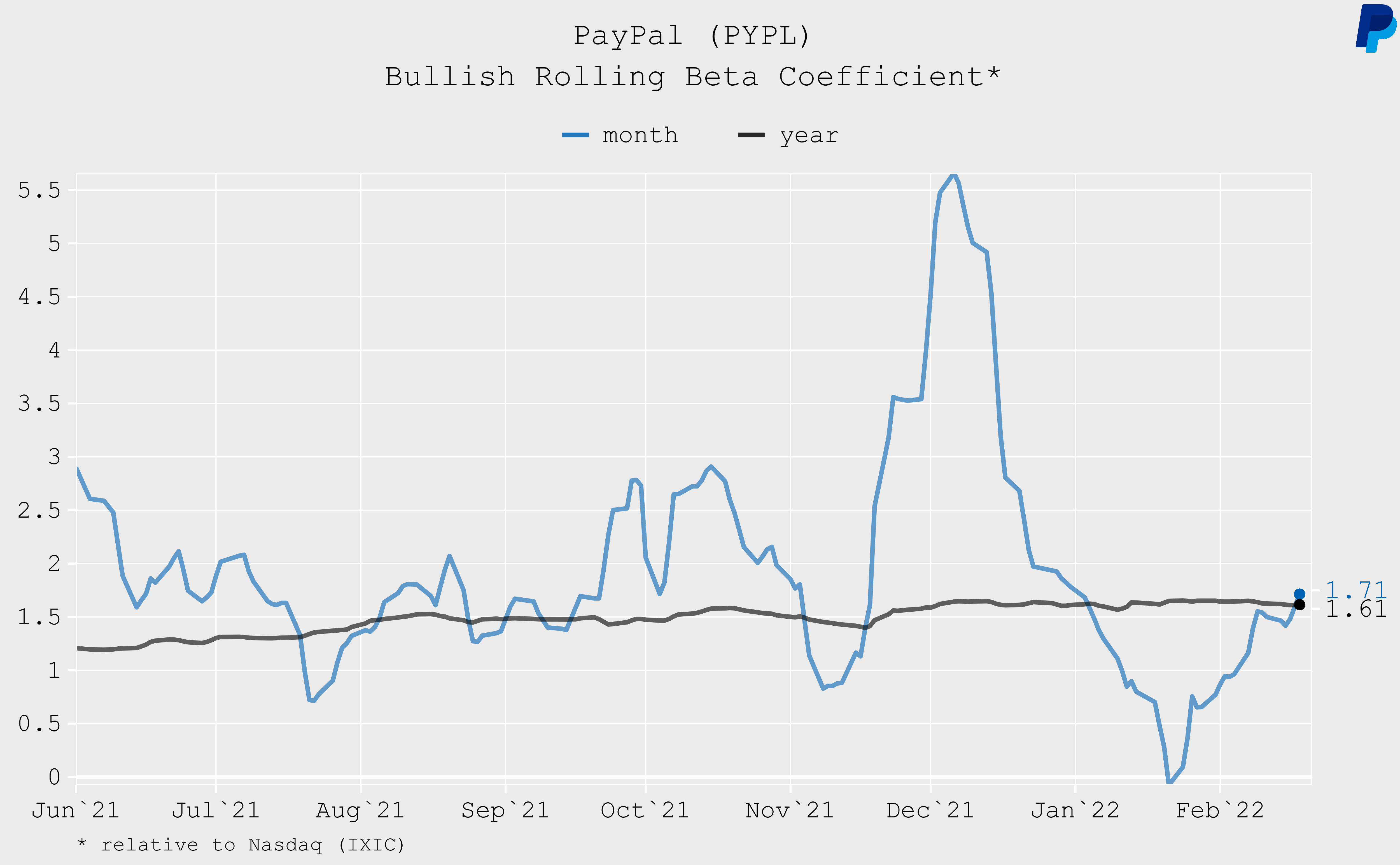

A relatively useful technical indicator of stock behavior is the Beta coefficient. In very simplified terms, this coefficient indicates how

much the price of a given stock tends to move in the same direction as the market.

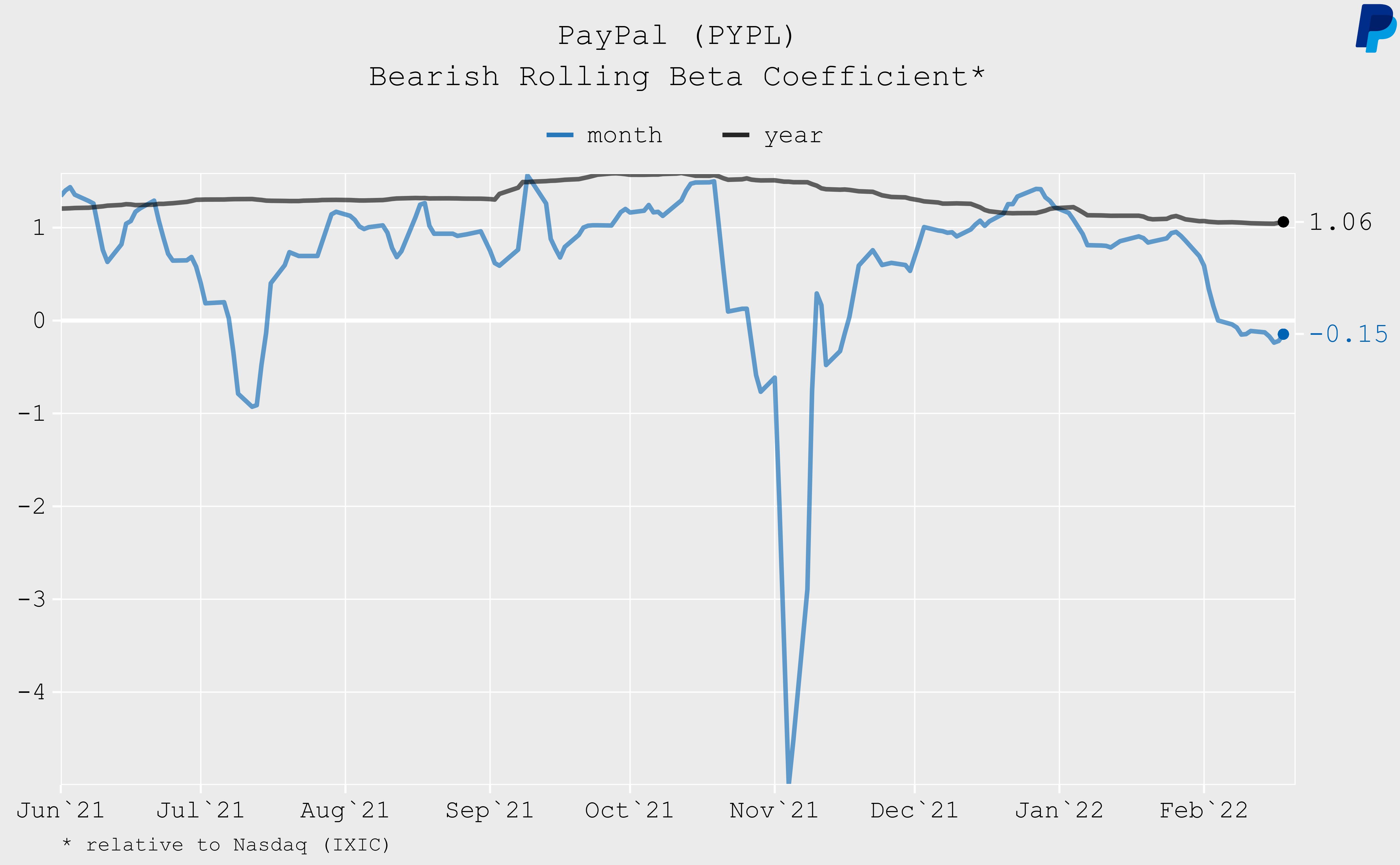

However, one can go further and evaluate how the price of a given stock tends to move only when the market is rising, and only when the market is falling. I call such indicators "Bullish" and "Bearish" Beta.

In the case of PayPal, the rolling, monthly "Bullish" Beta dropped to zero in January. This means that the price of the PayPal share did not react to the growth of the Nasdaq index. But now this indicator is at a level above one. This means that on average, when the Nasdaq index rises by 1%, the price of PayPal shares tends to rise by more than 1%, to be more precise - by 1.7%:

精彩评论