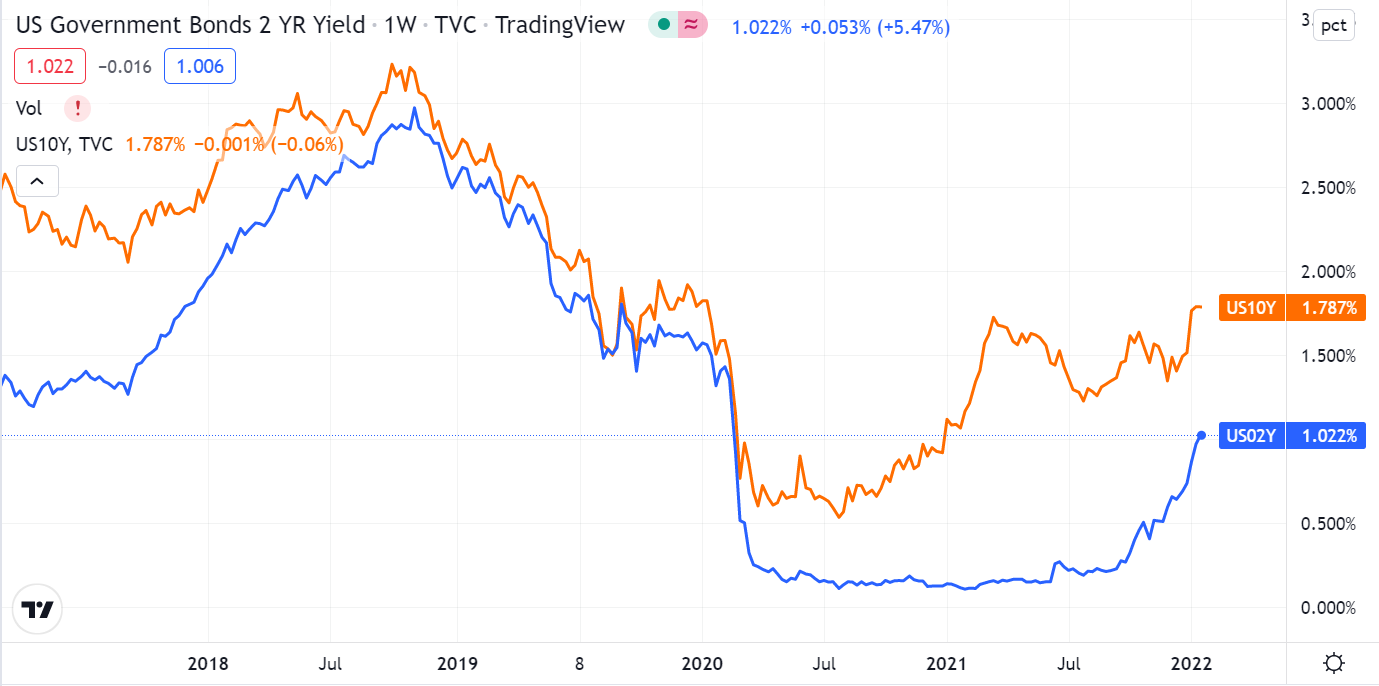

In recent years, Tech-stocks have become the key sector to drive the rise of U.S. stocks, but since 2022, due to the strong market expectations for the Fed to raise interest rates, the Benchmark U.S. Treasury yields jumped which has slammed the tech-stocks.

See the chart below,

U.S. bond yields rose rapidly, and U.S. stocks weakened collectively.However, under the expectation of strong interest rate hikes, the decline in US stocks may belong to a panic-style decline, which is normal market performance. In the future, U.S. bond yields are likely to rise.

In the future, U.S. bond yields are likely to rise.

According to Bernanke's framework, the main factors affecting the yield of ten-year US Treasury bonds are divided into three categories: the real natural interest rate, inflation expectations, and term premiums.

The main factor that drove the recent rapid rise in the U.S. Bond yields is inflation expectations.When inflation expectations rise, the Fed raises interest rates and the corresponding rate rises, and the yield requirements for U.S. bonds in the market will also increase.

But is the yields volatility of U.S. Bonds the most important reason for the decline in U.S. stocks?

The answer is NO.

But one period that needs to be pointed out is the end of 2000 to the beginning of 2021, due to the positive economic data and the large-scale economic stimulus plans in the United States, even if inflation concerns exist, the market believed that the pandemic was under control, and the economy was expected to rebound. Then, no major correction happened in the stock market.

History shows that the large impact of QE on bond yields usually occurs when the policy is announced, not when it is implemented. Therefore, once the market fully takes the rate hike expectations into account, the stock index may stabilize and rebound.

Overall, from a fundamental point of view, the economic recovery and strengthening fundamental background are the core factors to support the continued rise of U.S. stocks.

精彩评论