Is Palantir Stock Built on Hype?

As one of the most popular stocks with individual investors, is it product of hype, or is there something more?

We will remember 2021 for many things, such as the continuation of COVID-19, 7% inflation, and markets that touched all-time highs. It was also the year of the meme stock, in which companies like GameStop (NYSE:GME) and AMC Entertainment Holdings (NYSE:AMC) skyrocketed while being pushed by message boards like WallStreetBets of Reddit.

Palantir Technologies (NYSE:PLTR) also routinely appears among the 10 most-popular stocks on WallStreetBets. But despite its popularity, it underperformed the market in 2021. Is this a sign of what's to come?

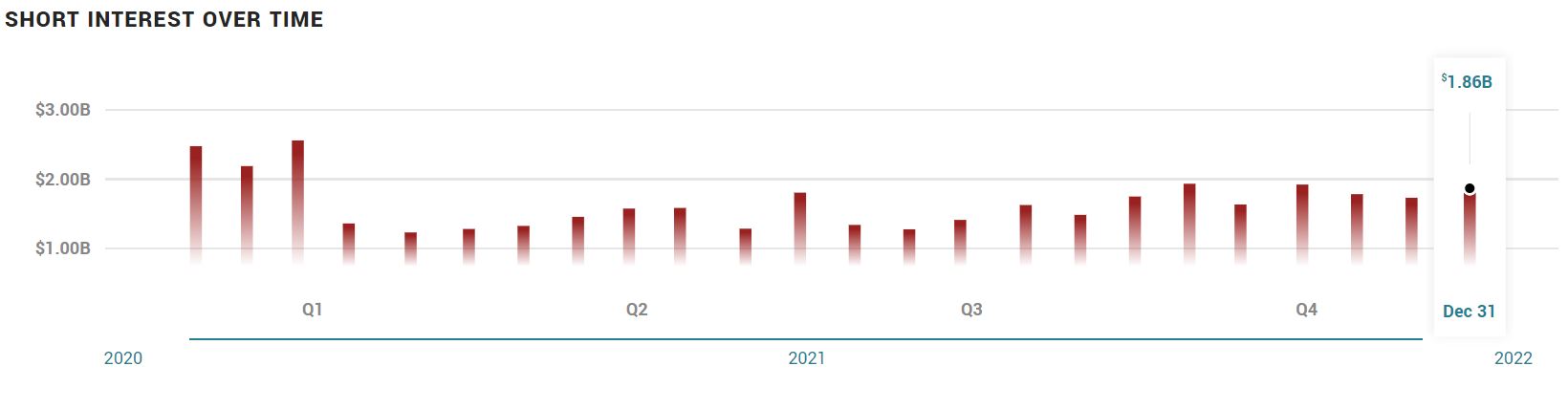

Short Interest : 102 Million sold

S&P reports that 102M shares of Palantir are sold short. This is almost 3x average daily volume on a stock that once rallied 176% in 3 weeks.

Source: MarketBeat

Palantir is a software data management company. Specifically, the company creates platforms for integrating, managing, and securing data for their clients. Using the platform, the client is able to quickly answer complicated queries using huge amounts of data. Palantir offers clients three main products; Gotham, Foundry, and Apollo.

Gotham is an Artificial Intelligence(AI)-ready operating system. This system enables faster decision making by analyzing complex data for insights. It has been used for disaster relief and by defense agencies and is also available commercially. Foundry is described by Palantir as the "operating system for the modern enterprise." It is an integrated platform that provides analytics, model-building, visualization, and other functions. The Apollo product is the delivery system that powers Palantir's software platforms. It also enables customers to operate away from the public cloud which is often necessary for military organizations. Palantir services both the public and private sectors.

Palantir stock reached highs of $45 in early 2021 after debuting just a few months prior at only $10. This was during the height of the short-squeezes fueled by individual investors and message boards. The stock quickly retreated from these highs, and the share price has underperformed ever since. However, there are reasons for optimism along with reasons for continued concern.

Prolific revenue growth

Palantir has not had any issues growing its revenue recently. In the third quarter of 2021, the company reported top-line sales of $392 million. This came in 36% higher than the $289 million posted in the year-ago quarter. It also grew its customer base, with commercial customers increasing 46% quarter over quarter. The company also gained large customers with deep pockets. In the third quarter, it reported deals with the U.S. Air Force, National Institutes of Health, and U.S. Department of Health and Human Services. In total, the company reported 54 deals that were worth more than $1 million.

Palantir also has an excellent gross margin and adjusted operating margin. For the third quarter, the gross margin under generally accepted accounting principles (GAAP) was an impressive 78%. This is an excellent sign that the company could scale successfully to GAAP net profits.

Palantir also reported an adjusted operating income of $349 million. On one hand, this is very impressive as it represents a margin of 32%. On the other hand, it highlights an issue that should give shareholders pause: the stock-based compensation (SBC) expense.

Stock-based compensation

As mentioned, Palantir reports a non-GAAP operating margin that is very impressive but continues to post GAAP operating losses. This is because the company removes SBC from the GAAP figures to arrive at the adjusted figures. Palantir uses a tremendous amount of SBC to reward executives and other employees. For the nine months ended Sept. 30, 2021, the company expensed over $611 million in SBC.

This generally causes the share count to increase and dilutes existing investors. However, it is not entirely negative. SBC also can preserve cash at a time when the company is spending heavily to grow the business. Because of the SBC, Palantir was able to post positive cash from operations through the third quarter 2021.

It also helps to attract and keep the best talent. It is no secret that the labor market is very tight. Attracting the best people can make a world of difference in the success of an enterprise. Finally, when insiders own shares of the business, their interests are aligned with those of shareholders.

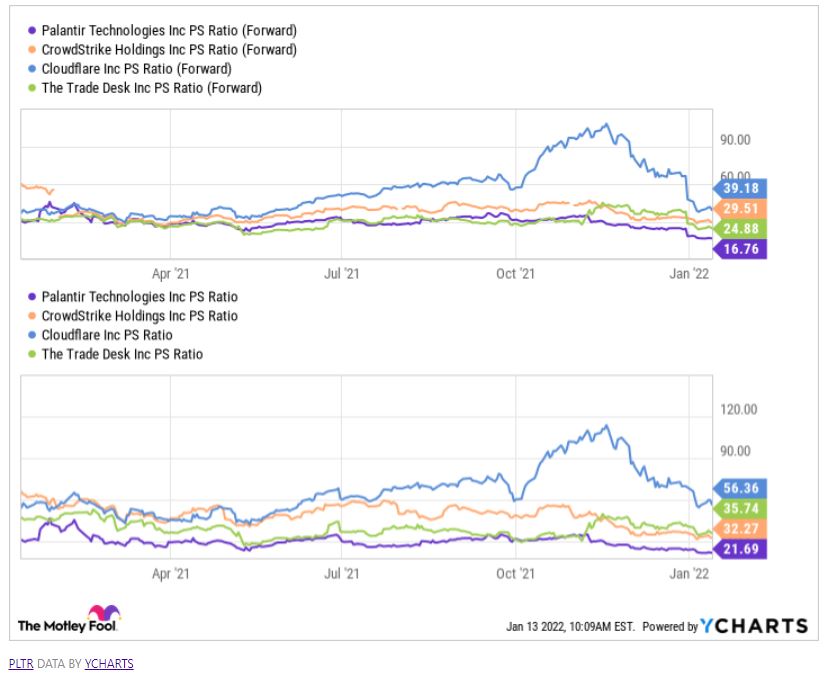

The valuation looks more attractive

Growth stocks have been hit hard so far in 2022. Inflation has breached 7%, and the Federal Reserve is set to raise rates, likely several times this year. This hurts growth stocks in particular, since Wall Street values them on future cash flows.

There also appears to be a general concern that valuations had gotten a bit ahead of fundamentals in 2021. This revaluation has caused Palantir to look much more attractive lately, especially compared to some other fast-growing tech stocks, as shown below.

The bottom line

Palantir remains one of the most popular stocks with individual investors, even after its underperformance in 2021 and so far in 2022. But it is not a stock built solely on hype. In fact, there is much to like in the recent results. Revenue continues to grow, and margins have expanded nicely. The company is now generating positive cash from operations, with a nice assist from its SBC program. The valuation has come down significantly, making Palantir more attractive than many other growth names. Even so, the swoon in tech stocks may not be over just yet, and investors should be cautious here.

精彩评论