Taiwan Semiconductor Reports Record Sales

$台积电(TSM)$'s revenue rose to a record in the first quarter of this year as demand for chips used in smartphones, computers and cars surged while a prolonged chip shortage helped to boost prices.

Revenue jumped 36% to NT$491.1 billion ($17 billion) in the the first quarter of 2022. Analysts estimated NT$469.4 billion on average.

TSM's strong revenue report highlights two key observations:

- Firstly, demand for semiconductor chips is still strong despite recent recessionary concerns. Semiconductors have essentially become the 'backbone of the economy as they are used in all kinds of digital appliances from smartphones to cars. These digital appliances are integral parts of our everyday lives which make them incredibly hard to forego. Therefore, despite fears that the US economy is headed towards a recession, I am still bullish on TSM as their products are incredibly sticky and inelastic in demand.

- Secondly, TSM demonstrated operational resilience in the face of supply chain disruptions. While the ongoing Russia-Ukraine crisis and the recent Covid-19 outbreak in Shanghai may have disrupted global supply chains, TSM was well-positioned to combat these disruptions. Even as many factories in China were forced to close down, TSM has kept production running in China. Chairman Mark Liu said that despite supply chain disruptions, TSM wasn't planning to revise its sales and capital spending forecasts for 2022. Thus, TSM's ability to navigate through supply chain issues and the pricing power it possesses make it a strong contender in the semiconductor industry and a stock to own for me.

Valuation

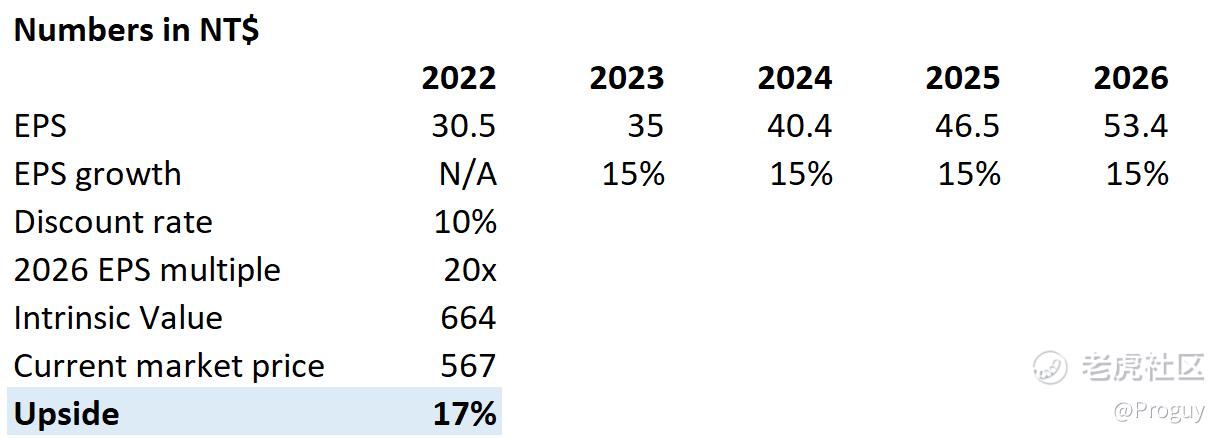

To determine the intrinsic value of TSM's shares, I used a 5 Year EPS growth model using an EPS growth rate of 15%, which was analysts' projected growth rate for 2023 and 2024. I believe that this growth rate will continue through 2026 with TSM continuing to dominate the semiconductor foundry sector. Using a discount rate of 10% and an EPS multiple of 20x, the intrinsic value of TSM's share was found to be NT$664 which is 17% higher than what is currently trading at. Therefore, I believe TSM's shares to be fundamentally undervalued, presenting an opportunity for investors to earn a positive capital gain.

$苹果(AAPL)$ $半导体指数ETF-HOLDRs(SMH)$

Disclaimer: This article is for educational/informational purposes and does not constitute investment advice. Perform your own due diligence and seek financial counsel before making any investment decisions.

精彩评论