重點摘要:

最知名的波動率ETN-「VXX」$短期VIX期货ETN(VXX)$ 預計將在2021.4.23進行反分割(Reverse split),這次是4股舊股合併成1股新股(1 for 4),目前(4/16)VXX股價為9.73。

這次反分割將在4/22收盤後生效,4/23投資人就可以看到調整後的股數,若是持有的股數無法被4整除,那麼畸零股將以現金方式退還,預計退還日為5/4。

新聞原文:

Barclays Bank PLC (“Barclays”) announced today that it will implement a 1 for 4 reverse split of its iPath® Series B S&P 500® VIX Short-Term Futures™ ETNs (CUSIP: 06746P621) (the “ETNs”) which it intends to be effective at the open of trading on Friday, April 23, 2021. The ETNs currently trade on the CBOE BZX Exchange (“CBOE”) under the ticker symbol “VXX.”

Barclays has the right (but no obligation) to initiate such a reverse split of the ETNs at its discretion on any business day, as described in the pricing supplement relating to the ETNs. On April 8, 2021 the closing indicative value of the ETNs was $10.3312.

The record date for the reverse split of the ETNs will be effective after the close of business, New York time, on April 22, 2021. The closing indicative value of the ETNs on the record date will be multiplied by four to determine the respective reverse-split adjusted value of the ETNs. The reverse split will be effective at the open of trading on April 23, 2021, and the ETNs will begin trading on the CBOE on a reverse-split adjusted basis on such date. The reverse-split adjusted ETNs will have a new CUSIP, but will retain the same ticker symbols.

Investors who, as of the record date, hold a number of ETNs that is not divisible by four will receive one reverse-split adjusted ETN for every four ETNs held on the record date and a cash payment for any odd number of ETNs remaining (the “partials”). The cash amount due on any partials will be determined on April 29, 2021, based on the closing indicative value of the reverse-split adjusted ETNs on such date and will be paid by Barclays on May 4, 2021.

心得感想:

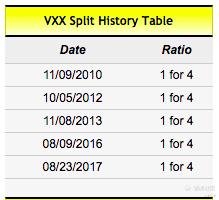

這次將會是VXX第6次的反分割,過去5次也都是 1 for 4 的比例:

基本上反分割完後對投資人權益完全沒有影響,就單純股價上漲4倍,而持有的股數變為1/4。先分享這個訊息給大家,到時4/23 VXX價格突然上漲時別太緊張~~放輕鬆放輕鬆 [龇牙] [龇牙] [龇牙]

精彩评论