S&P 500 and the DOW have been hitting new high. Even NASDAQ is back to test its all time high.

If you are still wondering why your portfolio are not performing despite the indices keep pushing historical high, you are not alone.

The on-going sector rotation has been tricky. If you did not catch the stocks where the hot money flooded into, you are likely missed out the strong rebound and rally while holding the under-performed stocks.

So, where are the hot money?

For the past Sunday's update, I have mentioned Homebuilders (Ticker: ITB) and Semiconductors (Ticker: SMH). I've also shared some out-performing stocks like AMAT, ASML, LRCX, MCD, YUM, MTZ, TPX, EBC etc...If you catch some of those, congratulations.

On top of these,Retail (Ticker: XRT) and Airlines (Ticker: JETS) have been outperforming.Large cap growth (Ticker: IVW)is leading the rally.

If you are too busy (or lazy) to do the research, check out my video below where I hand-picked stocks showing volatility contraction pattern (VCP) that is likely to breakout and start the up trend from the re-accumulation phase (Just like MCD, YUM, etc..).

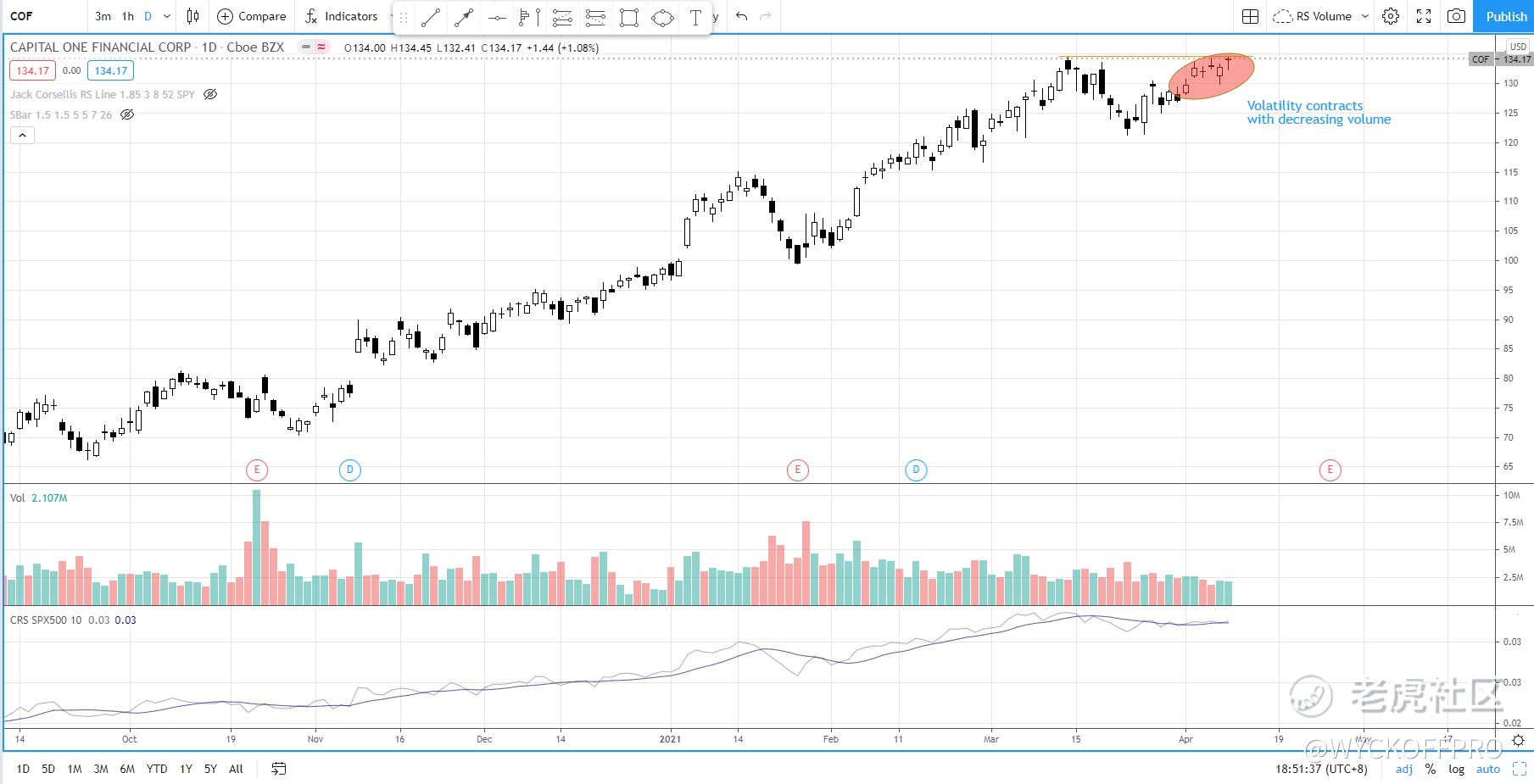

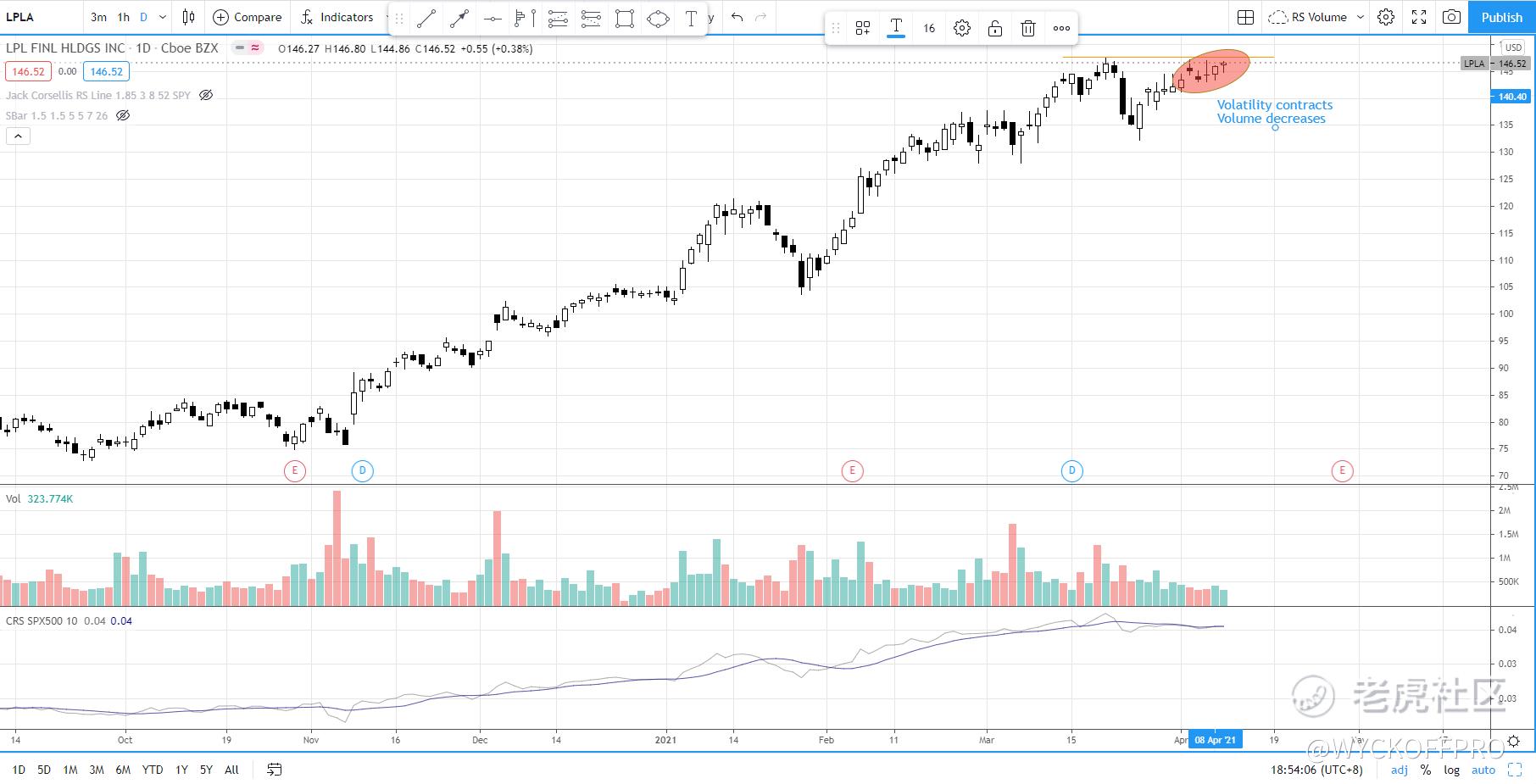

US: Mark Minervini Volatility Contraction Patterns Spotted in COF, COHR, LPLA— Time To Breakout?

Volatility contraction patterns (VCP) which was popularized by Mark Minervini have been spotted in $第一资本(COF)$ , $Coherent(COHR)$ and $LPL Financial Holdings Inc(LPLA)$ , which could be the signal prior to a start of the uptrend.

Find out how to trade the breakout with volatility contraction patterns to catch the potential explosive move to the upside.

A breakout (with expanding volume) above the pivot point resistance could trigger long entry with anticipation of higher targets.

精彩评论