U.S. stock index futures were subdued on Wednesday ahead of minutes from the Federal Reserve's December meeting, even as big technology stocks continued to fall, with Salesforce.com declining after a brokerage downgrade.

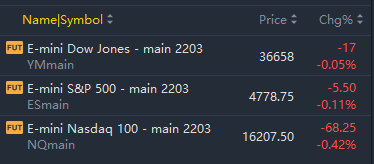

At 7:47 a.m. ET, Dow e-minis were down 17 points, or 0.05%, S&P 500 e-minis were down 5.5 points, or 0.11%, and Nasdaq 100 e-minis were down 68.25 points, or 0.42%.

Private job growth totaled 807,000 for the month, well ahead of the Dow Jones estimate for 375,000 and the November gain of 505,000 according to ADP.

Stocks making the biggest moves premarket:

Beyond Meat(BYND) – Beyond Meat surged 9% in premarket trading on news that KFC will roll out the company’s fried chicken substitute nationwide starting Monday, following tests in a number of markets.

Pfizer(PFE) – The drug maker’s shares gained 1.5% in the premarket following a Bank of America upgrade to “buy” from “neutral”. The upgrade is based on factors that include the rollout of the oral Covid-19 pill Paxlovid as well as significant pipeline investments. Additionally, Pfizer signed a new collaboration agreement with German partnerBioNTech(BTNX) to develop an MRNA-based shingles vaccine. BioNTech rose 1.7%.

Nikola(NKLA) – Nikola gained 2.2% in premarket action after logistics companyUSA Truck(USAK) announced a deal to buy 10 electric Nikola trucks. Separately, Nikola has dropped a $2 billion patent lawsuit againstTesla(TSLA), according to a federal court filing in San Francisco. The electric car maker had sued Tesla in 2018, accusing its rival of copying several of its designs.

Alibaba(BABA) –Daily Journal Corp. has nearly doubled its stake in the Chinese e-commerce giant, according to a regulatory filing.Berkshire Hathaway’s Charlie Munger is chairman of Daily Journal. Alibaba fell 1% in the premarket.

Sony(SONY) – Sony announced plans to create an electric vehicle unit, and displayed a prototype sport utility vehicle at the Consumer Electronics Show in Las Vegas. Shares rallied 4.2% in the premarket.

MillerKnoll(MLKN) – The office furniture maker’s stock slid 3.1% in premarket action following a weaker-than-expected quarterly report. MillerKnoll earned an adjusted 51 cents per share, 6 cents below estimates, with revenue also below Wall Street forecasts. Order demand was strong, but the company was hurt by supply chain and labor disruptions.

Garmin(GRMN) – Garmin was upgraded to “buy” from “hold” at Deutsche Bank, with the firm citing several factors including valuation of the GPS device maker’s shares as well as the high quality of its financials and a favorable business environment. Garmin added 1.2% in premarket trading.

Adobe(ADBE) – The software maker slid 2.2% in the premarket after being downgraded to “neutral” from “buy” at UBS after the firm spoke with more than a dozen IT executives about their 2022 spending plans. UBS thinks more spending was pulled forward into 2020 and 2021 than is generally assumed.

Pinterest(PINS) – The image-sharing site’s stock added 1.7% in premarket trading after Piper Sandler upgraded it to “overweight” from “neutral”. Piper said the recent sell-off in the stock presents a good buyi

精彩评论