U.S. stock index futures rose marginally on Thursday, as easing worries around the Omicron variant put the S&P 500 and the Dow on track to extend record-setting runs, with focus turning to a weekly jobless report to gauge the country's economic health.

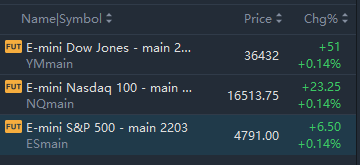

At 8:33 a.m. ET, Dow e-minis were up 51points, or 0.14%, S&P 500 e-minis were up 6.5 points, or 0.14%, and Nasdaq 100 e-minis were up 23.25points, or 0.14%.

Initial filings for unemployment insurance dipped last week and remained close to their lowest level in more than 50 years, the Labor Department reported Thursday.

Jobless claims for the week ended Dec. 25 totaled 198,000, less than the 205,000 Dow Jones forecast and a dip of 8,000 from the previous period.

When adjusting for weekly volatility, the four-week moving average for claims came to 199,250, the lowest level since Oct. 25, 1969.

Stocks making the biggest moves premarket:

Biogen (BIIB) – Biogen slid 6.5% in the premarket after Samsung denied a report in the Korea Economic Daily publication that it was in talks to buy Biogen and combine it with its biotech unit. Biogen shares had jumped 9.5% Wednesday on that report.

JetBlue (JBLU) – The airline cut nearly 1,300 flights from its schedule through January 13, as it deals with a surge in Covid-19 infections among its flight staff. JetBlue was down 1% in premarket action.

Didi Global (DIDI) – The China-based ride-hailing company’s shares slid 3.2% in premarket trading after it reported a 1.7% decline in third-quarter revenue and a loss of $4.7 billion. Didi had slumped 8.2% Wednesday and has fallen in 12 of the past 15 trading days.

R.R. Donnelley (RRD) – The business communications and marketing services company received an unsolicited, non-binding acquisition proposal at $11 per share in cash. R.R. Donnelley already has an agreement in place to be acquired by affiliates of private equity firm Chatham Asset Management for $10.85 per share. Donnelley shares jumped 3.1% in premarket trading.

Virgin Orbit (VORB) – The satellite-launching spin-off of space travel company Virgin Galactic will begin trading under the Virgin Orbit name and ticker on Nasdaq today after shareholders of blank-check company NextGen Acquisition Corp. II approved the merger earlier this week.

Micron Technology (MU) – The memory chip maker’s stock lost 1.5% in the premarket after it warned that Covid-19 curbs in China’s Xian tech hub would impact production. Samsung Electronics – which is also one of the world’s biggest memory chip makers, issued a similar warning.

Johnson & Johnson (JNJ) – A booster dose of the J&J Covid-19 vaccine was found to be 85% effective in preventing hospitalizations in a South African study, which has yet to be peer-reviewed.

Microstrategy (MSTR) – The business analytics company’s stock rose 1.1% in the premarket, tracking a rise in bitcoin prices. Microstrategy has bitcoin holdings worth several billion dollars on its balance sheet.

精彩评论