Stock-market index trade higher after inflation report.

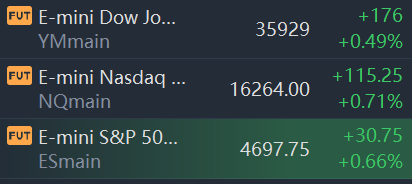

At 8:34 a.m. ET, Dow e-minis were up 176 points, or 0.49%, S&P 500 e-minis were up 30.75 points, or 0.66%, and Nasdaq 100 e-minis were up 115.25 points, or 0.71%.

Inflation accelerated at its fastest pace since 1982 in November, the Labor Department said Friday, putting pressure on the economic recovery and raising the stakes for the Federal Reserve.

The consumer price index, which measures the cost of a wide-ranging basket of goods, rose 0.8% for the month, good for a 6.8% pace on a year over year basis and the fastest rate since June 1982.

Excluding food and energy prices, so-called core CPI was up 0.5% for the month and 4.9% from a year ago, which itself was the sharpest pickup since mid-1991.

The Dow Jones estimate was for a 6.7% annual gain for headline CPI and 4.9% for core.

Stocks making the biggest moves premarket:

Tesla(TSLA) – Tesla Inc Chief Executive Officer Elon Musk has sold another 934,091 shares of the electric vehicle maker worth $963.2 million, U.S. securities filings showed on Thursday.He also exercised stock options to buy 2.17 million shares of Tesla, according to the filings.Musk is "thinking of" leaving his jobs and becoming an influencer, the world's richest man tweeted on Thursday.It was not immediately clear if Musk, a prolific user of the social media platform, was being serious about quitting his roles.Tesla shares dropped more than 1% in premarket trading.

Oracle(ORCL) – Oracle shares surged 12% in the premarket, after quarterly sales and revenue beat estimates and the business software company announced a $10 billion increase in its share repurchase program. Oracle earned an adjusted $1.21 per share, 10 cents above estimates, with particular strength for its cloud infrastructure business.

Broadcom(AVGO) – The chip maker’s shares rallied nearly 7% in premarket trading after it beat Street forecasts on the top and bottom lines for its latest quarter. Broadcom earned an adjusted $7.81 per share, 7 cents above estimates, and also issued an upbeat forecast on continued high demand from its cloud computing customers.

Chewy(CHWY) – The online pet products retailer’s stock tumbled 10% in the premarket after it reported a wider-than-expected quarterly loss. Sales were in line with Street forecasts, but profit was impacted by higher costs for labor and supply chain issues.

Moderna(MRNA) – Moderna shares plunged 10% in premarket trading.Other vaccine stocks also fell.BioNTech fell more than 5%,Novavax fell more than 3%.

Lululemon(LULU) – The athletic apparel maker reported adjusted quarterly profit of $1.62 per share, 21 cents above estimates, with revenue slightly above forecasts as well. However, Lululemon also warned that new Covid-19 variants could impact demand for “athleisure” clothing if virus concerns lead to temporary store closures and further supply chain issues. The stock slid 1.3% in premarket action.

C3Ai(AI) – The artificial intelligence software company’s stock soared 20% in the premarket after it won a $500 million contract from the U.S. Department of Defense for its suite of AI products.

Costco(COST) – The warehouse retailer earned $2.98 per share for its latest quarter, compared with a consensus estimate of $2.64, with revenue topping Street forecasts as well. The beat came despite higher costs and supply chain issues that Costco said it was able to largely mitigate. Costco rose 1.8% in the premarket.

Beyond Meat(BYND) – Restaurant chain Taco Bell dropped plans to test Beyond Meat’s plant-based version of carne asada,according to a Bloomberg report. Taco Bell is said to have been dissatisfied with samples it received in October, although the companies continue to work together on new products. Beyond Meat slipped 1.6% in premarket trading.

American Outdoor Brands(AOUT) – The outdoor products maker reported adjusted quarterly profit of 58 cents per share, well below the 76 cent consensus estimate, with revenue also falling short of analyst forecasts. The company said sales slowed due to a shift in customer purchase timing into the prior quarter to lessen supply chain concerns. American Outdoor shares plummeted 19% in premarket action.

Vail Resorts(MTN) – The resort operator lost $3.44 per share for its latest quarter, smaller than the loss of $3.62 that analysts had anticipated, thanks to a jump in season pass sales. However, revenue was below estimates.

Peloton(PTON) – The fitness equipment maker’s shares lost 3.6% in the premarket after Credit Suisse downgraded the stock to “neutral” from “outperform”. The firm noted a number of headwinds for Peloton, including a return to out-of-home fitness and a shift in consumer spending.

AMC Entertainment(AMC) – The movie theater operator’s shares slid 1% in premarket trading, after SEC filings showed a sale of 312,500 shares by CEO Adam Aron and a sale of 18,000 shares by CFO Sean Goodman. Aron had indicated in November that he would soon begin selling shares as part of estate planning.

精彩评论