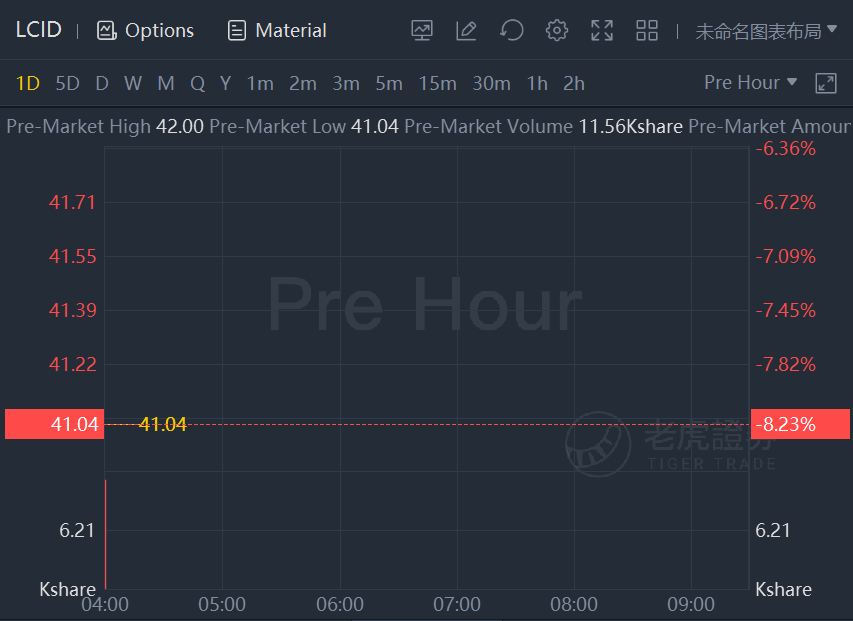

Lucid stock plunged 8% in premarket trading as the electric vehicle maker plans to sell $1.75B aggregate principal amount of convertible senior notes due 2026 in a private offering.

Lucid Group, Inc announced its intention to offer, subject to market and other conditions,$1,750,000,000aggregate principal amount of convertible senior notes due 2026 in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. Lucid also expects to grant the initial purchasers of the notes an option, for settlement within a period of 13 days from, and including, the date the notes are first issued, to purchase up to an additional$262,500,000principal amount of notes.

The notes will be senior, unsecured obligations of Lucid, will accrue interest payable semi-annually in arrears, and will mature onDecember 15, 2026, unless earlier repurchased, redeemed, or converted. Noteholders will only have the right to convert their notes in certain circumstances and during specified periods. Lucid will settle conversions of notes by paying or delivering, as applicable, cash, shares of its Class A common stock (the "common stock") or a combination of cash and shares of its common stock, at Lucid's election. The notes will be redeemable, in whole or in part (subject to certain limitations), for cash at Lucid's option at any time, and from time to time, on or afterDecember 20, 2024and on or before the 31st scheduled trading day immediately before the maturity date, but only if the last reported sale price per share of Lucid's common stock exceeds 130% of the conversion price for a specified period of time and certain liquidity conditions are satisfied. The redemption price will be equal to the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date. The interest rate, initial conversion rate and other terms of the notes will be determined at the pricing of the offering.

Lucid intends to allocate an amount equal to the net proceeds from the notes to finance or refinance, in whole or in part, one or more new or existing "Eligible Green Investments," including the development, manufacture, or distribution of products, key components, and machinery related to electric vehicles or energy storage systems, as well as investments and expenditures related to renewable energy, energy efficiency, and sustainable water and waste management. Pending such allocation, Lucid intends to use the net proceeds of the offering for business expansion and general corporate purposes, which may include investing in our manufacturing capabilities, expanding and improving operations such as our retail and service network, investing in research and development, and supporting other potential growth opportunities.

精彩评论