“交易策略的必备关键要素 - 第一节 (上)

在海啸式的抛售之后,市场似乎终于进入了巩固阶段。在大家重整我们的交易部位之时,也许这也是我们反思自己的交易风格和习惯的好时机。为我们为下一波的波动做好准备。

www.pzhconsultants.com

“Critical Trading Strategy Components”- Part 1

The market finally seems to have entered into a consolidation phase after a Tsunami styled selloff.While the market picked up the pieces and re-calibrate its bearings, perhaps this is also a good time for us to reflect on our trading styles and habits.If nothing else, it will prepare us for the next wave as the volatility returns.

“在做交易时最可悲的是拥有了正确的市场观点但却输钱” - “The saddest thing that can happen in trading is to have the right view but yet lose money”

A lot of us talk about our market views and trading strategies but not many of us take a systematic approach towards planning and executing one.Let’s ask ourselves, how many times did we have the correct assessment of the market but yet came out short?What happened?I mean, we had the right view to begin with. Shouldn’t that should be half the battle won? Why did we end up not making or even losing money? A fellow trader once shared with me this saying, “The saddest thing that can happen in trading is to have the right view but yet lose money”.Wise words indeed.So what went wrong?

市场观点和交易策略比比皆是,但很少人采用有系统的方法来计划和执行我们的交易策略。问自己,有多少次我们对市场进行了正确的评估,但最终没有获利?有了正确的市场观点, 不应该是成功的一半吗?为什么我们最终不赚钱甚至亏本?一位交易员曾经与我分享这句话:“在做交易时最可悲的是拥有了正确的市场观点但却输钱”。名言。问题到底出在哪里?

The answer is simply this.Having the right call of the market direction is nothing but the first step in forming the winning trading strategy.In fact, there are a few more components that form the trading strategy that are actually more critical than direction.It is arguable that one would even conclude that Direction is the least difficult component to decide because it is ultimately a digital decision.It is either up or down.In this series of “Critical Trading Strategy Components”, I shall share with you what the other components of a winning trade strategy are. We shall begin with “Product”.

答案如下。正确的市场观点,只是形成获胜交易策略的第一步。实际上,交易策略内的其他要素实际上比确定市场方向更重要。我们甚至可以得出这个争议性的结论,市场方向是最容易决定的交易策略要素,因为它最终是个二元决策。市场不是上就是下。在本系列“交易策略的必备关键要素”中,我将与您分享成功交易策略的其他关键要素。我们先从“产品”开始。

Product

最有效和最有效率的方式来表达自己的观点 - allow me to express my view in the most efficient and effective manner

In the planning of a trading strategy, choosing the right product is essential to our success.The reason is because each market product and instrument behaves differently.This can due to the differences in product specifications, locality of which the product is traded, market participants of trading that product etc.For example, let’s just assume we have a bullish view of the stock market.So the immediate response for the novice trader is let’s just buy! But the next question he should be asking be instead, “what should I be buying that will allow me to express my view in the most efficient and effective manner?”.

在制定交易策略时,选择正确的产品来表达我们的市场观点对于整个策略的成功至关重要。原因是因为各交易产品和工具有着各自的不同。这可能是因产品规格,所交易产品的交易范围,交易该产品的市场参与者等方面的差异所造成。例如,假设我们对股市持有看涨的观点,对于新手交易者而言,立即的反应就是“买”!但是,他应该问的下一个问题是:“我应该购买什么才可以让我以最有效和最有效率的方式来表达自己的观点?”。

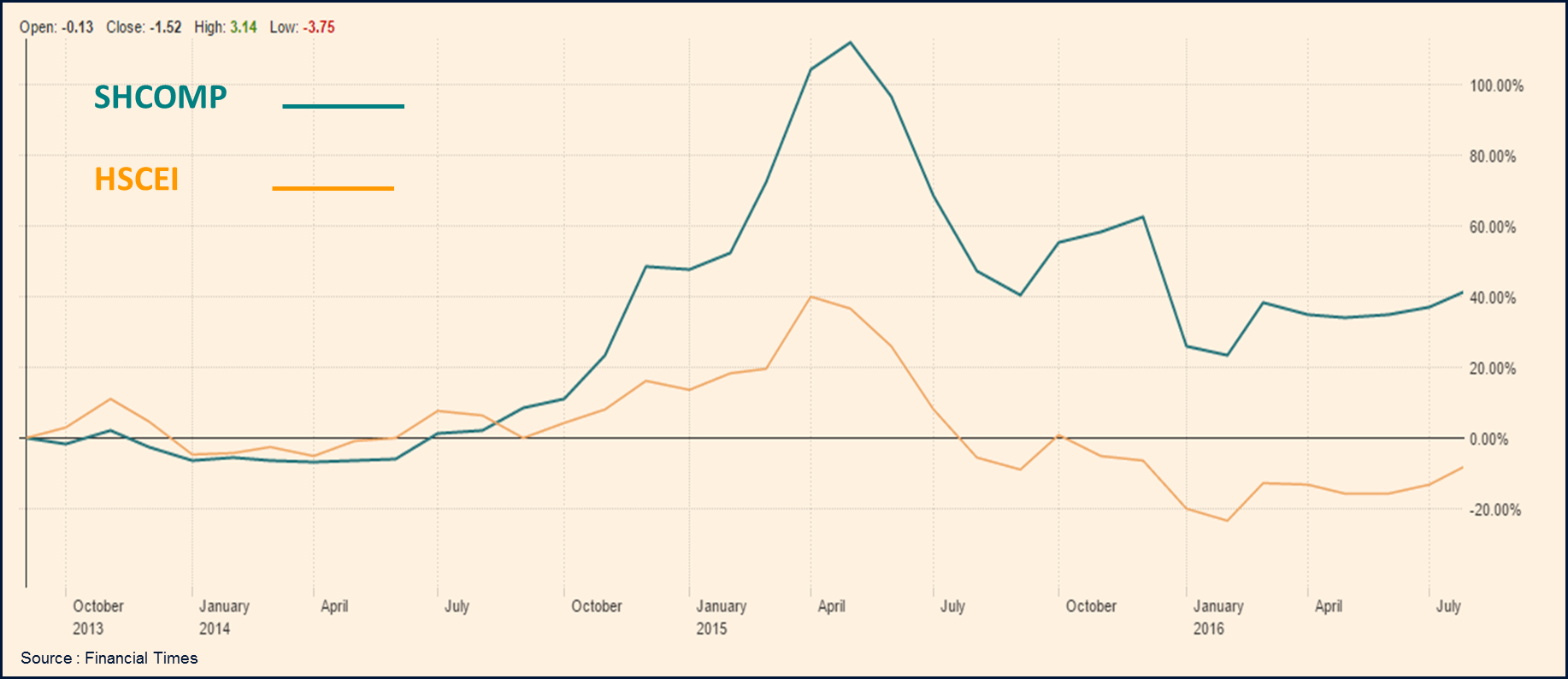

The Chinese stock market from mid-2014 to mid-2016 clearly illustrates the importance of choosing right horse for the race. Back in July 2014, PBOC started slashing interest rates.The Chinese stock market naturally reacted very well to the news and rallied.At that point of time, all Chinese stock market indices rose.However, HSCEI which consist of red-chips listed in HK was clearly lagging behind SHCOMP, the onshore Chinese SHCOMP index.This market phenomenon is interesting because most of the stocks in HSCEI are cross-listed in SHCOMP. Ie. There should not be a significant difference in their prices across the two exchanges.The reality is that, there is and that price difference continued to widen even as both stock indices rallied through the 2015 equities boom.To the trader that expressed his bullish view via HSCEI, he might think that although it is not rallying as fast as the onshore market, a win is a win and the gap might eventually narrow.

2014年中至2016年中的中国股市清楚地说明了选择合适的产品来表达我们的市场观点的重要性。早在2014年7月,中国人民银行就开始下调利率。中国股市也因此攀升。当时,所有中国股市指数均上涨。然而,在香港上市的红筹股筹股组成的HSCEI指数明显落后于中国在岸SHCOMP指数。有趣的是,HSCEI指数中的大多数股票同时也在上海交易所同时挂牌。两个股指的价格不应有显著的差异。实时上,即使两个股指都在2015年的股市牛市攀高,价格差异仍在继续扩大。对于选择HSCEI指数来参与牛市的交易员而言,他可能会认为,尽管回升速度不及在岸市场,但还是赚了钱,两者的差距也可能最终缩小。

尽管水涨船高,一旦市场转向,最弱的股票将是跌幅最快的股票 - Even though the rising tide will raise all ships, the fundamentally weakest stocks will be the ones dropping the fastest when the market turns

Unfortunately, the lower relative return is not the only problem that had plagued this long HSCEI strategy.As we all recall (some of us painfully), the Chinese stock market eventually tanked as the bubble burst in Apr 2016.What followed is that both SHCOMP and HSCEI collapsed.However, from the chart, we can see clearly that although both indices suffered, SHCOMP retained a healthy portion of the bull run while HSCEI eventually went LOWER than where it had started before the bull run.For the trader who picked the wrong product (HSCEI) to express his bullish view, he had suffered a lower return during the rally and eventually ended up with a loss.The wrong of choice of index here ended up being disastrous.You did not make as much on the way up but lost a lot more on the way down!This example can extend to the importance of choosing the right individual stocks even when the market is in a broad-based rally. Even though the rising tide will raise all ships, the fundamentally weakest stocks will be the ones dropping the fastest when the market turns.

不幸的是,较低的相对收益率并不是这多HSCEI指数头寸策略的唯一问题。随着股市泡沫在2016年4月破裂后,中国股市最终陷入困境。各中国股指都崩溃了。但是,从图表中我们可以清楚地看到,尽管两个指数均受挫,但SHCOMP指数任然保住牛市的大半上升幅度,而HSCEI指数最终跌至比牛市前的低点。对于选择了错误产品(HSCEI)来表达他看涨的市场观点的交易员,他在上涨期间获益了较低的回报,并最终亏损。指数选择的错误最终造成了可悲的结果。他在股市上升时赚的不多,但在下降过程却输了很多!这个例子可以扩展到在牛市中,选择正确单一股票的重要性。尽管水涨船高,一旦市场转向,最弱的股票将是跌幅最快的股票。

Regardless if we are looking at a single stock or index, it is also important to pick the right product of the same underlying stock/index to express our view.The most common way to go long a stock is to buy the stock. However, there are other ways to go long which I will cover in my next article of Critical Trading Strategy Components.Stay tuned!

无论是选择单一股票或是指数,选择以相关股票/指数的正确产品来表达我们观点也很重要。表达股票上涨的最常见方法是购买该股票。但是,还有其他方法可以用来表达同样的观点。我将在我的下一篇“交易策略的必备关键要素”文章中和大家介绍。敬请锁定关注!

www.pzhconsultants.com/disclaimer.html

$FUT:SP500指数主连(ESmain)$$FUT:NQ100指数主连(NQmain)$$FUT:道琼斯指数主连(YMmain)$

$恒生指数(HSI)$$FUT:恒生指数主连(HSImain)$$FUT:H股指数主连(HHImain)$

$短期VIX期货ETN(VXX)$$FUT:VIX波动率主连(VIXmain)$

$WTI原油ETF(CRUD.UK)$$FUT:WTI原油主连(CLmain)$

$FUT:布油现金主连(BZmain)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 紫藤华夏·2020-03-27好机会来了1举报

- 颜家佃·2020-03-26别人授之以渔,只能自己捕鱼。1举报

- 大莹姐·2020-09-14看好理想汽车点赞举报

- 好玩吧幸福女性·2020-08-03亏本,查一查问题出在哪里点赞举报

- WUWO·2020-12-03666点赞举报

- 我也好想成为最出色的人·2020-11-13关注点赞举报

- 亏仔大B·2020-10-25我就瞎买点赞举报

- 李地震·2020-09-09好点赞举报

- 聽風觀雲·2020-04-08学习了1举报

- 发财猫888·2020-04-03知道1举报

- 上善若水955·2020-03-316661举报

- 戴维斯双杀·2020-03-27好2举报

- 清清棋坛·2020-03-27总结经验1举报

- 宸赫·2020-03-27对1举报

- 及时抽身·2020-03-27,h1举报

- 苏苏丫丫·2020-03-276661举报

- fsfvghxxbgn·2020-03-278881举报

- 雪碧两块五·2020-03-266661举报